Customer Stories

Case studies and videos showcasing the value of GovOS software suites.

How Longmont, CO Modernized Tax Filing to Empower Staff and Serve Its Growing Community

The City streamlined tax filing services for businesses and centralized the management of multiple tax types via GovOS.

Driving Innovation with Technology in Lawrence County, PA

The Register and Recorder reflects on the County’s evolution from paper-heavy processes to cutting-edge digital solutions—highlighting a strong partnership with GovOS and a commitment to serving constituents more efficiently.

The Evolution of Records Technology in Lawrence County, PA

The County transformed its records office—from manual microfilm and paper books to efficient, accessible eRecording—improving turnaround times, reducing in-person traffic, and enhancing public access to vital documents.

Lawrence County, PA Sets the Standard for eRecording Innovation

The County has embraced eRecording to streamline document processing, accelerate turnaround times, and deliver faster, more efficient service through secure digital submissions.

Lawrence County, PA Leads the Way in Self-Service Record Access

The County is redefining public service with modern self-service tools—from online eRecording and cloud-based record access to fraud protection alerts—making it easier than ever for constituents to access vital services anytime, anywhere.

Bexar County, TX Expands Access to Thousands of Historical Records

In partnership with GovOS, Bexar County digitized centuries of historical documents, enabling the public to access them online for free. Discover the impact of this project on the community.

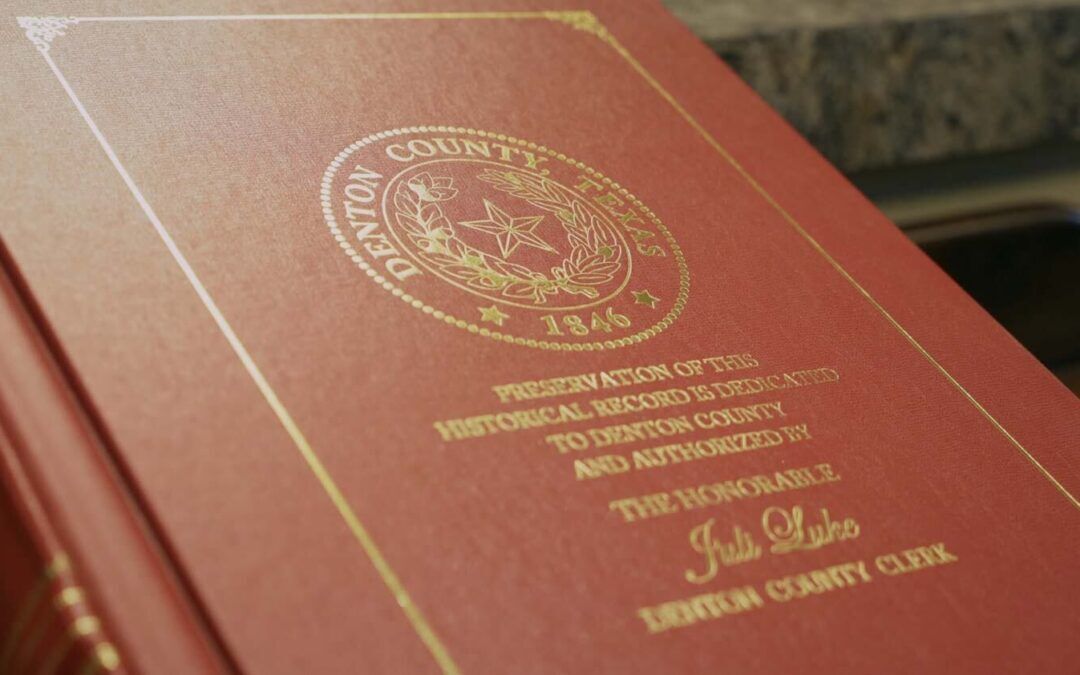

Why Cloud Matters: How GovOS Keeps Denton County, TX Ready for Anything

Denton County, TX highlights the impact of GovOS’ cloud-based solution for property records management. From disaster recovery to remote access, GovOS ensures that essential records remain secure and accessible anytime, anywhere, helping the county serve its community without interruption.

Cloud-Powered Innovation: Denton County, TX Modern Solution for Records Management

Discover how Denton County uses GovOS’ technology to manage over 200,000 property recordings annually and serve over a million residents with a streamlined, efficient approach.

How Berks County Transformed Remote Access and Efficiency With New Search Capabilities

Explore how Berks County’s advanced public search system enables comprehensive document searches, remote work flexibility, and uninterrupted service during critical times.