Discover how Okaloosa County, FL uses GovOS to create dynamic public dashboards that improve transparency, streamline tax reporting, and empower decision-makers with actionable data.

Avenu, GovOS, and ITI Merge to Form Neumo – The Future of Government Software – Read the News | Learn More

Discover how Okaloosa County, FL uses GovOS to create dynamic public dashboards that improve transparency, streamline tax reporting, and empower decision-makers with actionable data.

Discover how local governments are improving business owner engagement through digital tools, user experience insights, and best practices for increasing online tax and license portal adoption.

Learn best practices for reconciliation and reporting using the GovOS BLT module, with tips on handling anomalies, ACH payments, and monthly revenue balancing.

Explore B&O tax in Washington state with a look at best practices for managing collections and compliance.

Wheat Ridge was recently featured in the news for launching new digital solutions, including one to provide a modern business licensing and tax filing experience.

Discover best practices to drive adoption, enhance efficiency, and maximize the value of your technology investments.

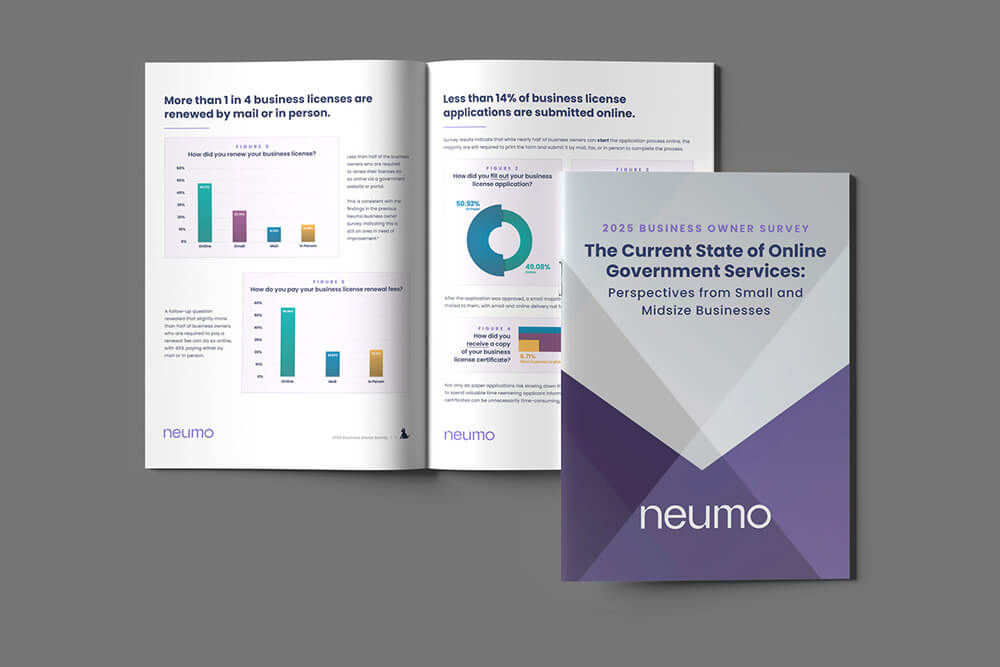

Discover key insights from the 2025 Business Owner Survey on how businesses engage with government digital services and the future of online solutions.

Discover the benefits of short-term rental compliance software, including increased compliance rates, time savings, and more.

Explore the results from the 2025 Business Owner Survey with strategies for agencies to meet evolving business owner expectations now and in the future.