Learn how implementing tax software can enable timely taxpayer notifications, bolster data security, and drive increased compliance.

Learn how implementing tax software can enable timely taxpayer notifications, bolster data security, and drive increased compliance.

Here are some of the key considerations for governments to take into account when evaluating tax collection software.

Explore how managing diverse tax types—like sales, occupational, and lodging taxes—within one system can benefit agencies and communities.

With the help of tax collection software, government agencies can deliver a modern, streamlined experience to taxpayers while eliminating many of the tedious manual tasks for staff. Here’s an overview of online tax collection and how the right system can improve compliance, increase revenue, and provide a single source of truth across multiple tax collection processes.

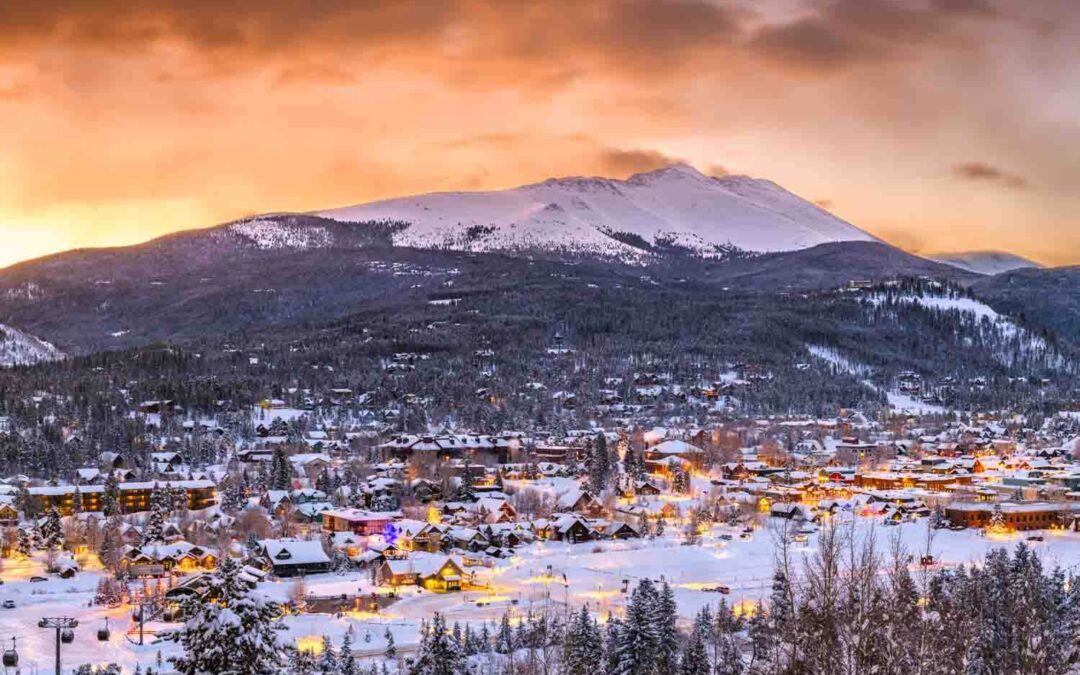

Watch how the town of Breckenridge, CO leaders support a thriving business community while ensuring a high quality of life for residents.

Learn how local governments can add transparency to the tax collection process to help build trust, reduce complexities, and improve compliance.

Here’s a look at how implementing software to automate income tax processes benefits local governments, payroll providers, and individual filers.

The easier it is for tax filers, the timelier the delivery of funds to your agency. Here’s how local governments can simplify the tax filing process.

Here are six findings from the latest GovOS report that will impact the relationship between businesses and local governments in the year ahead.