Explore how Berks County’s advanced public search system enables comprehensive document searches, remote work flexibility, and uninterrupted service during critical times.

Avenu, GovOS, and ITI Merge to Form Neumo – The Future of Government Software – Read the News | Learn More

Explore how Berks County’s advanced public search system enables comprehensive document searches, remote work flexibility, and uninterrupted service during critical times.

Explore how software helps government agencies streamline compliance, manage licenses, and enhance regulatory efficiency.

Discover how the Iowa Department of Transportation continually innovates with technology to streamline operations and prioritize an exceptional customer experience.

Learn the key differences between digital and electronic documents and how they support security, accessibility, and efficiency in government records management.

Learn how Berks County, PA digitized all records dating back to sovereignty to centralize and secure historical documents while protecting against potential disasters.

In Dauphin County, modernization is driven by the innovative use of dedicated improvement funds. This video highlights the County’s commitment to continuous improvement and innovation in public service.

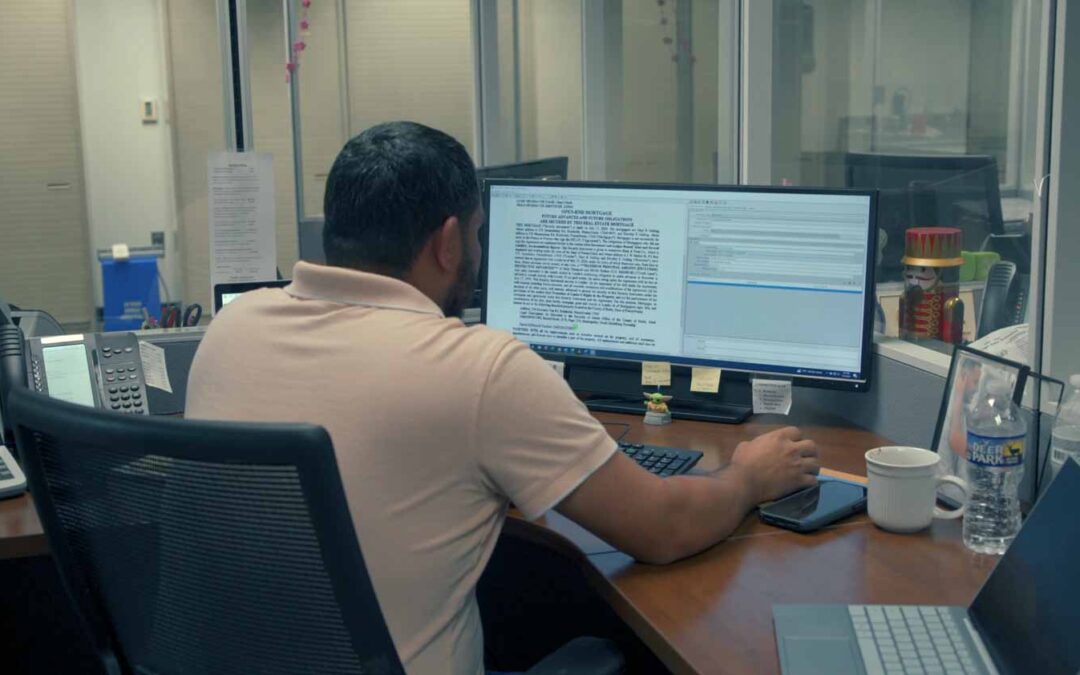

Discover how the Recorder of Deed’s Office increased efficiency, reduced manual tasks, sped up document recording, and improved records workflows.

Neer to continue focusing on company strategy as she transitions from chief strategy officer to board advisor role.

Explore innovative ways local governments leverage sales and use tax revenue for their communities.