A Guide to Short-Term Rentals for Local Governments

Chapter 1

What is a Short-Term

Rental?

Chapter 2

Using Software to Manage Short-Term Rental Compliance

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Providing Short-Term Rental Resources to Your Community

Chapter 7

Short-Term Rental Policies & Practices Across the U.S.

Chapter 1

What is a short-term rental?

A short–term rental is typically defined as a rental of any residential home unit or accessory building for a short period of time. This generally includes stays of less than a month (30 days), but the maximum length can vary depending on the state and jurisdiction in which the rental is located.

Such rentals are also sometimes referred to as transient rentals, vacation rentals, short-term vacation rentals, and resort dwelling units. So, the answer to a question like “What is a short-term rental?” may well include terms like these depending on the location, agency, or organization with which you’re dealing.

What are the different types of short-term rentals?

Short-term rentals are often divided into different categories, such as entire homes, accessory dwellings or individual rooms. If the owner designates the property as their homestead 51% of the time or more, it’s usually considered an owner-occupied dwelling. If not, the property would be considered a non-owner-occupied dwelling.

Entire homes

A rental property can be considered a short-term rental if the owner spends most of the time there but occasionally rents out the whole home for a few days or weeks, up to a maximum number of days per year.

Additionally, if an absentee owner rents out their property for short stays, up to a given number of days per year, that would also be considered a short-term rental.

Accessory dwellings

If an owner were to rent out a portion of a property they live in – such as a guest house or garage apartment – for short periods of time that, too, would be considered a short-term rental.

If an absentee owner were to rent out similar accessory dwellings for a given number of days per year on a property they own but do not live in, that also would be considered a short-term rental.

Rooms

If an owner rents out one or more rooms in their primary home for short stays, up to a maximum number of days per year, that’s considered a short-term rental.

If an owner were to do this but live off-site at a different property, it would still be considered a short-term rental.

Does the definition of a short-term rental vary between jurisdictions?

Certain jurisdictions make further distinctions between different types of short-term rentals, complicating the “what is a short-term rental?” question. While some areas differentiate between single-family and multi-family homes, others make a distinction between short-term rental properties located in areas zoned as residential and properties located in commercial or multi-use areas. Some will divide short-term rental properties where the owner is present for the entire time of the rental from those where the owner is not present for the full duration.

Local government websites should provide the community with detailed information about how the jurisdiction defines a short-term rental.

What does the future of short-term rentals look like?

The continued popularity of companies like Airbnb and Vrbo show that short-term rentals aren’t just a big-city phenomenon. There is now a global boom, with the number of listings for short-term rental properties growing every year with hundreds of different short-term rental websites in existence.

Considering the growth of the sharing industry, it’s becoming more and more important for communities to engage with all stakeholders in the short-term rental industry. Studies show most short-term rental owners/operators are unaware of the rules around compliance and community preservation issues. Our short-term rental host compliance software opens the lines of communication driving higher compliance rates.

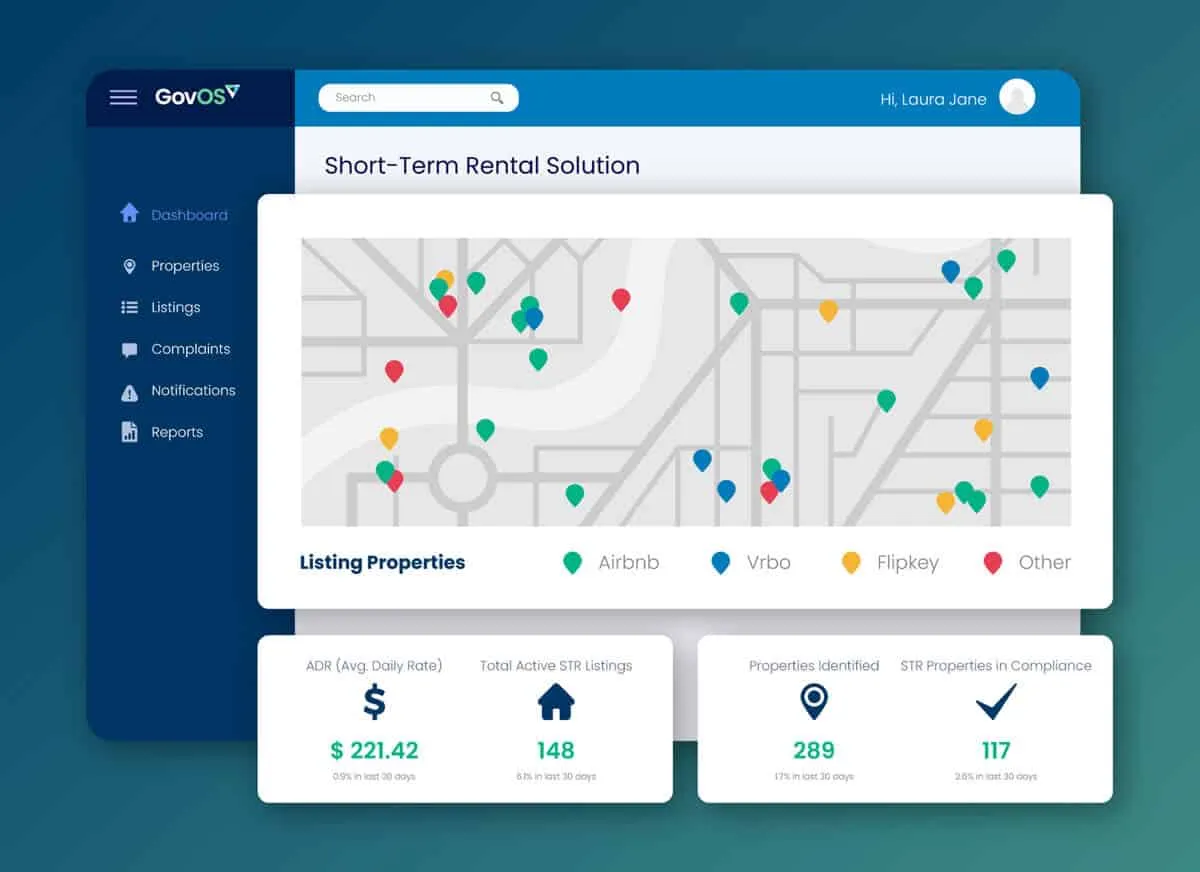

Navigating the world of short-term rentals and the many different distinctions made can be difficult, but with the help of the GovOS Short-Term Rental Solution, your community will have the insights needed to identify undetected revenue. With solutions for short-term rental identification, host compliance, tax collection, licensing, and a hotline, you can upgrade your reporting process without impacting staff time.

The benefits aren’t just limited to increased revenue and efficiency – GovOS tools enable cities to communicate changes and bridge the adoption gap around compliance, health, and safety with real-time notifications.

Watch a series of demos to see how the GovOS STR solution can work for you!

Chapter 2

Using Software to Manage Short-Term Rental Compliance

With a growing number of STR properties to account for, local governments are setting up programs to manage short-term rental compliance and must determine whether they want to do so manually or with the help of software. Before making a decision, it can help to explore the advantages and challenges of using software vs. in-house resources.

Chapter 3

Short-Term Rental Identification

An essential step in effectively managing short-term rentals is collecting accurate data to identify the number of rental properties operating in the area. By gathering and maintaining accurate information about short-term rental activity, the community can make data-driven decisions that benefit all stakeholders.

Additional Resources

Chapter 4

Setting Up a Short-Term Rental Registration System

Another important step in short-term rental management is implementing a registration system. The way local governments configure this system will likely vary depending on state and local legislation as well as the agency’s own unique goals.

Additional Resources

Access the Local Government Guide to Short-Term Rentals

on-Demand Webinar

How Deschutes County, OR Works with Short-Term Rentals

Chapter 5

Collecting Taxes from Short-Term Rentals

For many jurisdictions, the additional tax revenue from short-term rentals is an essential way they reinvest in the community. Simplifying the tax payment process by bringing it online is a proven way to increase compliance and ultimately benefits both citizens and staff.

Success Story

Bald Head Island Utilizing the Short-Term Rental Solution in Their Jurisdiction

Chapter 6

Providing Short-Term Rental Resources to Your Community

The most effective short-term rental management programs connect the community’s STR hosts with resources for operating safely and respectfully while giving residents an easy way to voice concerns.

Wondering how many active STRs are in your community?

Chapter 7

Short-Term Rental Policies & Practices Across the U.S.

From beach communities and ski towns to desert destinations and hidden gems in the mountains, here’s a look at some of the different ways local governments across the country are managing short-term rentals.

Additional Resources